The United States is poised to scrap its long‑standing $800 “de minimis” duty‑free threshold for most goods arriving from China (and potentially other countries) as early as May 2 2025, following an executive order and a companion CBP rule‑making package now moving through public comment. Millions of parcels that once sailed through customs tax‑free will suddenly require full customs entries, duties, and partner‑agency compliance data. The change targets platforms such as Temu and Shein—whose business models rely on shipping individual low‑value packages direct to U.S. shoppers—and is being backed up by multiple bipartisan bills in Congress. E‑commerce merchants, 3PLs, marketplaces, and consumers should expect higher landed costs, slower clearance, and new data‑collection obligations, while CBP insists the measure is necessary to stem illicit trade and level the playing field for domestic firms.

Jump right in: U.S. to Scrap $800 Duty‑Free De Minimis Shipping in 2025

US Scraps $800 Duty-Free Shipping: 2025 Impact

1. What the De Minimis Rule Is Today

Since 2016, Section 321 of the Tariff Act has allowed goods valued at ≤ $800 to enter the U.S. without duties or most taxes so long as each consignee receives only one such package per day.U.S. Customs and Border Protection CBP now processes ≈ 4 million of these shipments daily, up from roughly 1 million in 2018.U.S. Customs and Border Protection

Why It Grew So Fast

- 2016 TFTEA hike from $200 → $800 lowered compliance friction.Forbes

- Chinese fast‑fashion and variety apps Temu & Shein built logistics pipelines that exploit the rule, letting them undercut U.S. retailers.TimeAllAmerican.org

- Low inspection rates made it attractive for counterfeiters and fentanyl traffickers, according to bipartisan Senate letters.U.S. Senator Rick ScottNPR

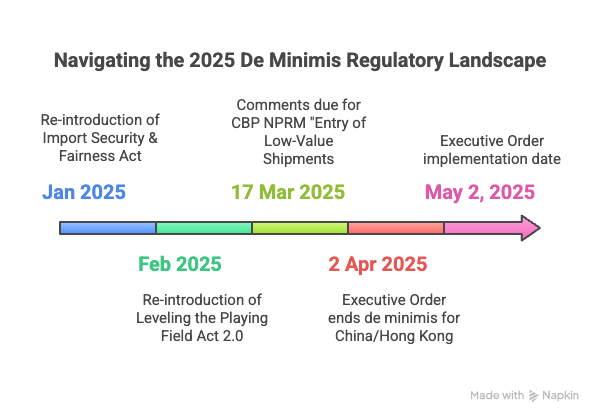

2. The Regulatory & Legislative Pivot in 2024‑25

|

Instrument |

Scope |

Status (Apr 2025) |

|

Executive Order (Trump, 2 Apr 2025) |

Ends de minimis for China/Hong Kong May 2. |

|

|

CBP NPRM “Entry of Low‑Value Shipments” |

Adds data fields, allows CBP to declare items ineligible, and hard‑codes elements of the Type 86 pilot. |

Comments due 17 Mar 2025; final rule expected summer 2025. (source: Federal RegisterU.S. Customs and Border ProtectionInternational Trade Insights) |

|

Import Security & Fairness Act (H.R. 322) |

Bars de minimis for non‑market economies & forced‑labor‑listed entities; reduces threshold to $10 if country of origin uncertified. |

Re‑introduced Jan 2025; House Ways & Means hearing scheduled. (source: Congress.gov | Library of Congress) |

|

Leveling the Playing Field Act 2.0 |

Lets Commerce cumulate serial small shipments to prove injury, speeds AD/CVD cases. |

Re‑introduced Feb 2025; bipartisan Senate support. (source:Senator YoungCongress.gov | Library of Congress) |

|

End China’s De Minimis Abuse Act |

Total ban on de minimis from China; mandates quarterly reporting. |

Draft discussion paper; not yet filed. (source: AllAmerican.org) |

Canada and Mexico retain de minimis relief for now under separate executive orders.

Worried about rising import costs from the new tariffs?

eFulfillment Service can help you optimize your logistics and protect your margins. Get a Free U.S. Fulfillment Quote!

3. Effective Date & Implementation Scenarios

|

Date |

Likely Action |

Notes |

|

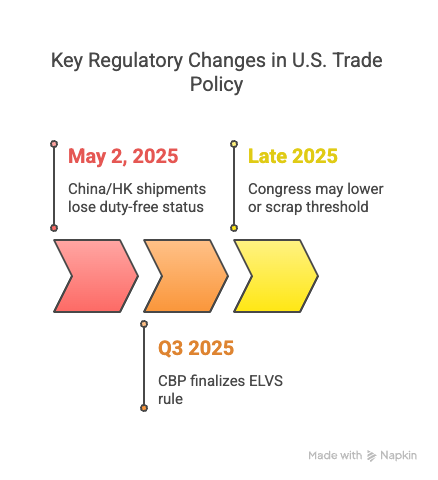

May 2 2025 |

China/HK shipments lose duty‑free status. |

Orders placed before cutoff but arriving after still pay duties.AxiosNPR |

|

Q3 2025 |

CBP finalizes ELVS rule: expanded data, denied‑party filters, possible item‑level exclusions (apparel, food, OTC drugs). |

Brokers must map SKU‑level HTS and PGA data into Type 86‑like entries.Federal Register |

|

Late 2025 |

Congress may lower or scrap the threshold for all countries via H.R. 322 or similar. |

Revenue estimate $8–$12 b/year.Congress.gov | Library of CongressCorn Refiners Association |

4. De Minimis Removal Impact Analysis

4.1 E‑Commerce Marketplaces

Temu & Shein say prices will rise 15‑25 % to cover duties and re‑warehouse stock in the U.S. They have already cut U.S. ad spend by ~20 %.

4.2 U.S. Brands & 3PLs

- More trans‑load volume: Overseas sellers may seek U.S. 3PLs to bulk‑import, store, and domestic‑ship.

- Higher entry workload: Expect surging formal entries (< $800) that still need broker filing; 3PLs may need additional compliance staff.

- Opportunity to pitch reliability & returns processing as differentiators over direct‑from‑factory models.

4.3 Consumers

Bloomberg estimates a $10 shirt could cost $12‑13 post‑duty plus brokerage fees. Delivery times could lengthen 2‑5 days as Type 86 or formal entries queue for inspection.

Tariffs cutting into your profits?

Switching to a smarter U.S.-based 3PL like eFulfillment Service can reduce overhead and improve delivery times. Request Your Free Quote Now!

4.4 Compliance & Data

- Mandatory ACE filings: more HTS detail, shipper IDs, IOSS‑style seller data.U.S. Customs and Border Protection

- Forced‑labor & UFLPA flags: will render shipments automatically ineligible.

5. International Benchmarks

- EU: Abolished €22 low‑value VAT relief July 2021; saw 7 % rise in customs revenue, minimal e‑commerce slowdown.

- U.K.: Removed £15 threshold Jan 2021; marketplaces collect VAT at point of sale on goods ≤ £135.

These examples suggest price increases are real but manageable if platforms pre‑collect taxes and streamline border data.

6. Action Checklist for Supply‑Chain & Marketing Teams

|

Timeline |

To‑Do |

|

Now – Apr 30 |

|

|

By May 1 |

|

|

Q2 2025 |

|

|

Before CBP Final Rule |

|

|

Marketing |

|

Tariff changes are here—are your fulfillment strategies ready?

Let eFulfillment Service help you adapt with flexible, cost-effective solutions. Start with a Free Quote Today.

Summary: U.S. to Scrap $800 Duty‑Free De Minimis Shipping in 2025

The phase‑out of the U.S. de minimis duty‑free privilege marks a structural shift for cross‑border e‑commerce. While it raises near‑term costs and complexity, it also nudges the market toward more transparent, compliant supply chains—creating opportunities for U.S. 3PLs that can offer duty‑paid inventory positioning, faster domestic delivery, and rigorous product‑safety screening.

Take the Next Step: Need help with fulfillment and inventory management?

Learn more about eFulfillment Service’s Fulfillment Solutions and how we help brands streamline operations from warehousing to delivery. By partnering with experts, you can spend less time worrying about tariffs and more time growing your business.

💡 eFulfillment Service specializes in helping eCommerce businesses scale without the headaches. Whether you’re managing one SKU or a few thousand, we provide the technology, automation, and expertise to keep your operations running smoothly.

📞 Ready to simplify your rewards fulfillment and focus on growth? Contact us today to see how we can help streamline your operations and improve efficiency.

Need help with fulfillment? eFulfillment Service specializes in flexible, multi-channel fulfillment, including Amazon FBA prep services. Contact us today for a free quote and see how we can streamline your operations!

0 Comments